WEDNESDAY, SEPTEMBER 10, 2025

- Home

- Top 50 tourist destinations to be developed in partnership with states: Sitharaman

Top 50 tourist destinations to be developed in partnership with states: Sitharaman

Published on Feb 1, 2025

By PTI

Share

Read below Union Budget 2025-2026 highlights

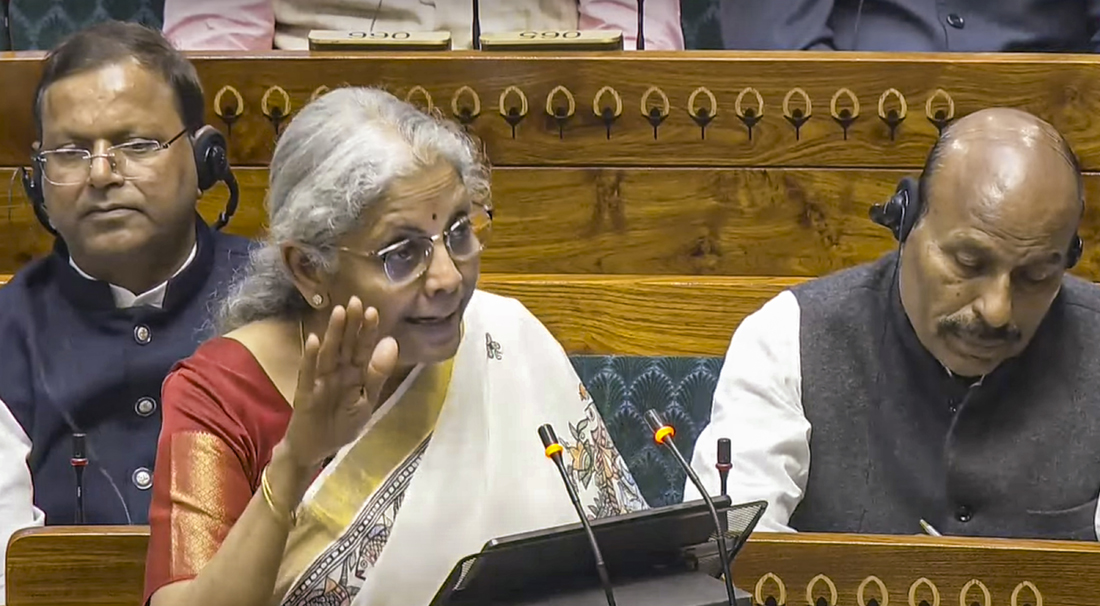

Union Finance Minister Nirmala Sitharaman presents the Union Budget 2025-26 in the Lok Sabha, in New Delhi, Saturday, Feb. 1, 2025. (Sansad TV via PTI Photo)

- NEW DELHI — Union Finance Minister Nirmala Sitharaman on Saturday said the top 50 tourist destinations in the country will be developed in partnership with states in a "challenge mode", as she emphasised tourism as a driver of employment-led growth and unveiled a series of initiatives aimed at bolstering infrastructure, skill development and ease of travel.

-

- The Ministry of Tourism has been earmarked a significant increase in its Budget allocation for the 2025-2026 fiscal, with a focus on enhancing tourism infrastructure, promoting domestic and international travel, and ensuring the safety of tourists, particularly women.

-

- The total Budget allocation for the ministry for 2025-2026 stands at Rs 2,541.06 crore, marking a substantial increase from the revised estimate of Rs 850.36 crores in 2024-2025.

Also read: Union Budget 2025-26: 10,000 additional seats in medical colleges, daycare cancer centres

Tax booster for middle class: No income tax payable on income up to INR 12 lakh

Presenting her eighth straight Union Budget, Sitharaman said the government will promote homestays by extending Mudra loans, and improve connectivity to tourist spots to enhance accessibility.

-

- "The state governments will be responsible for providing land to build essential infrastructure. To further boost tourism, hotels in the key destinations will be included in the harmonised infrastructure list, ensuring better access to financing and development support," she said.

-

- Outlining the broader roadmap, Sitharaman said, "We will facilitate employment-led growth by organising intensive skill development programmes for our youth, including institutes of hospitality management."

-

- States that demonstrate effective destination management -- including maintaining tourist amenities, cleanliness, and marketing efforts -- will receive performance-linked incentives, the finance minister said.

-

- The government will also introduce streamlined e-visa facilities and visa fee waivers for select tourist groups to attract international visitors, she said.

-

- Reaffirming the focus on spiritual and heritage tourism set in the Budget last July, Sitharaman highlighted the special initiatives for sites associated with Gautama Buddha's life.

-

- Medical tourism, under the 'Heal in India' initiative, will also receive a boost through public-private partnerships (PPPs), capacity building, and relaxed visa norms.

-

- A major portion of the Budget for the tourism ministry has been allocated to tourism infrastructure development, with Rs 1,900 crores earmarked for the Integrated Development of Tourism Circuits under the Swadesh Darshan scheme.

-

- This initiative focuses on creating theme-based tourist circuits across the country, emphasising high-value, competitive, and sustainable tourism.

-

- Additionally, the Pilgrimage Rejuvenation and Spiritual Heritage Augmentation Drive (PRASHAD) scheme, aimed at developing pilgrimage and heritage sites, also received substantial funding to enrich spiritual and cultural tourism experiences.

-

- The Centre has prioritised promotion and publicity, allocating funds for both domestic and international campaigns. Efforts will be made to promote India's diverse tourist destinations, with a special focus on the Northeast region and Jammu and Kashmir.

-

- Internationally, the tourism ministry plans to position India as a premier tourist destination through targeted marketing campaigns in key markets such as Spain, China, and France.

-

- The establishment of representative offices in the new markets is also part of the strategy to attract more international tourists.

-

- To address the growing demand for skilled manpower in the tourism sector, the ministry has been allocated Rs 60 crore for training and skill development programmes.

-

- Initiatives like the "Hunar Se Rozgar Tak" programme aim to train youth, particularly from underprivileged backgrounds, to meet the sector's needs.

-

- The ministry is also focusing on certifying the skills of service providers and promoting entrepreneurship in the tourism industry.

-

- In a significant move to ensure the safety of women tourists, the ministry has introduced the Safe Tourist Destination for Women scheme, funded by the Nirbhaya Fund.

-

- This initiative aims to create a secure and women-friendly environment at tourist destinations, allowing women to travel without fear of crime or harassment.

-

- The scheme reflects the government's commitment to making tourism more inclusive and safe for all, as per the ministry.

-

- The Budget also includes investments in public enterprises such as the India Tourism Development Corporation (ITDC) and Kumarakom Frontier Hotels Pvt Ltd, with allocations of Rs 70.42 crore and Rs 10 crore, respectively.

-

- These investments are expected to boost tourism infrastructure and services, particularly in the key tourist destinations.

-

- Additionally, the Northeastern region continues to be a priority, with an allocation of Rs 240 crore for 2025-2026 to support the development of tourism infrastructure and promote the region as a prime tourist destination.

-

- Union Budget 2025-2026 highlights

-

- Imported life saving drugs, medicines to become cheaper; knitted fabrics, smart meter costlier

-

- Imported life saving drugs and medicines used in the treatment of cancer, rare and other severe chronic diseases, along with imported premium cars and motorcycles, are set to become cheaper with Finance Minister Nirmala Sitharaman announcing cuts in customs duty in the Union Budget 2025-26.

-

- However, certain items like interactive flat panel (touch screen) displays imported as fully built units and certain knitted fabrics will become costlier due to increase in basic customs duties.

-

- In her speech, Sitharaman said, "To provide relief to patients, particularly those suffering from cancer, rare diseases and other severe chronic diseases, I propose to add 36 lifesaving drugs and medicines to the list of medicines fully exempted from basic customs duty (BCD)."

-

- She further said, "I also propose to add six lifesaving medicines to the list attracting concessional customs duty of 5 per cent. Full exemption and concessional duty will also respectively apply on the bulk drugs for manufacture of the above."

-

- The finance minister also announced that "specified drugs and medicines under Patient Assistance Programmes run by pharmaceutical companies are fully exempt from BCD, provided the medicines are supplied free of cost to patients."

-

- "I propose to add 37 more medicines along with 13 new patient assistance programmes," Sitharaman said.

-

- Although the government has cut duties on several imported items, including marbles, granite and footwear, the impact was neutralised by a hike in Agriculture Infrastructure and Development Cess (AIDC).

-

- Significantly, as per the budget announcement imported premium cars and other motor vehicles with CIF (cost, insurance, and freight ) value more than USD 40,000 (about Rs 35 lakh) or with engine capacity more than 3,000 cc for petrol-run vehicles and more than 2,500 cc for diesel-run vehicles or with both will become cheaper as the customs duty has been reduced to 70 per cent from 100 per cent earlier.

-

- Similarly, motorcycles with engine capacity of 1,600 cc and above imported in completely built unit (CBU) form will also be cheaper as tariff has been slashed to 30 per cent from 50 per cent.

-

- Likewise, bikes with engine capacity not exceeding 1,600 cc imported as CBU will also become cheaper as tariff has been cut to 40 per cent from 50 per cent.

-

- Motorcycles with engine capacity not exceeding 1,600 cc in imported semi knocked down (SKD) form and completely knocked down (CKD) form will also become cheaper as customs duties have been cut on these items too.

-

- There will also be reduction in prices of imported motorcycles with engine capacity of 1,600cc and above in SKD form following a cut in custom duty to 20 per cent from 25 per cent and the same imported in CKD form will now attract 10 percent duty, down from 15 per cent.

-

- The budget also announced reduction in customs duty on imported parts of electronic toys to 20 per cent from 25 per cent and that of synthetic flavouring essences and mixtures, used in food and drink industries to 20 per cent from 100 per cent.

-

- Similarly, articles of Jewellery, goldsmiths’ and silversmiths’ ware and ethernet switches of carrier grade will also become cheaper.

-

- On the other hand, smart meters, solar cells, imported footwear, imported candles and tapers; imported yachts and other vessels will become costlier as cut in import duties on these items have been offset by an increase in AIDC.

-

- PVC Flex Films, PVC Flex Sheets, PVC Flex Banner will also become costlier due to imposition of 7.5 per cent AIDC.

-

- Certain imported knitted fabrics are also like to be costiler as the custom duty structure on it has been changed to 20 per cent or Rs115/kg, whichever is higher.

-

- Interactive Flat Panel Displays which are imported as completely built units will also become costlier as the duty has been hiked to 20 per cent from 10 per cent earlier.

-

- FM says 1 cr more people will pay no income tax due to hike in rebate

-

- The government has put "substantial amount of money" in hands of people through rejig of I-T slabs in the Budget and an additional 1 crore people will pay no tax due to hike in tax rebate to Rs 12 lakh per annum, Finance Minister Nirmala Sitharaman said on Saturday.

-

- The 2025-26 Budget hikes the tax rebate available to individual taxpayer to Rs 12 lakh from next fiscal, from Rs 7 lakh currently.

-

- "One crore more people will pay no income tax due to hike in rebate to Rs 12 lakh," Sitharaman said at the post-Budget press conference.

-

- "Government has put substantial amount of money in hands of people" through I-T rate rejig, she said, adding that the government has responded to the voice of people.

-

- The Budget has revised the tax slabs for computing tax liability on income earned in 2025-26 for those with income of more than Rs 12 lakh and filing ITR under new tax regime.

-

- Under the new slab, income of up to Rs 4 lakh will be exempt. A 5 per cent tax will be levied for income earned between Rs 4-8 lakh, 10 per cent for Rs 8-12 lakh, 15 per cent for Rs 12-16 lakh.

-

- A 20 per cent income tax will be levied on income between Rs 16-20 lakh, 25 per cent on Rs 20-24 lakh and 30 per cent above Rs 24 lakh per annum.

-

- "We have reduced tax rates to benefit the middle class," Sitharaman added.

-

- Finance Secretary Tuhin Kanta Pandey said tax bouyancy of 1.42 is expected in next fiscal, lower than 2 in current fiscal.

-

- "We have assumed a moderate tax revenue bouyancy looking into the sacrifice of revenue (on account of rebate)," Pandey said.

-

- He said 75 per cent of the income tax filers have already moved to the new income tax regime. "We expect every taxpayer to shift eventually."

-

- Education in Budget: AI push, infra expansion at 5 new IITs, 10000 extra medical seats

-

- Infrastructure expansion at the five new IITs to facilitate 6,500 more students, 10,000 new medical seats and a big Artificial Intelligence push. These are among the big announcements made by the government for the education sector in the 2025-26 budget.

-

- The Ministry of Education has been allocated more than Rs 1.28 lakh crore in the Union Budget 2025-26, higher than the revised estimate of Rs 1.14 lakh crore in 2024-25.

-

- While the Higher Education department has been allocated an amount of Rs 50,067 crore, the school education department has received Rs 78,572 crore.

-

- Finance Minister Nirmala Sitharaman, who presented her eighth straight Union Budget, also said the government will launch 'Bharatiya Bhasha Pushtak' scheme to provide digital form of Indian language books for schools and higher education.

-

- She announced the government will create additional infrastructure at five Indian Institutes of Technology (IITs) and expand IIT Patna. The announcement to expand IIT Patna comes ahead of the Bihar Assembly polls due later this year.

-

- "The total number of students in 23 IITs has increased by 100 per cent from 65,000 to 1.35 lakh in the past 10 years. Additional infrastructure will be created in the five IITs started after 2014 to facilitate education for 6,500 more students. Hostel and other infrastructure capacity at IIT Patna will also be expanded," she said.

-

- The IITs have been allocated an amount of Rs 11,349 crore in the union budget, up from a revised estimate of Rs 10,467 crore in current financial year.

-

- Sitharaman announced that 10,000 additional seats will be added in medical colleges and hospitals next year towards the goal of adding 75,000 seats over the next five years.

-

- "Our government has added almost 1.1 lakh undergraduate and postgraduate medical education seats in 10 years, an increase of 130 per cent. In the next year, 10,000 additional seats will be added in medical colleges and hospitals towards the goal of adding 75,000 seats in the next five years," she said.

-

- The FM also announced 10,000 fellowships will be provided for technology research in IITs and IISc over the next five years.

-

- "Five national centres for excellence for skilling with global expertise and partnerships will be set up and 50,000 Atal Tinkering Labs will be set up in government schools in the next five years to cultivate scientific temper in young minds," she said.

-

- Sitharaman said broadband connectivity will be provided to all government secondary schools and primary healthcare centres in rural areas.

-

- "I had announced three centres of excellence in AI for agriculture, sustainable cities, and health in 2023. Now, a Centre of Excellence in AI for education will be set with an outlay of Rs 500 crore," she said, in a big Artificial Intelligence (AI) push in education.

-

- From University Grants Commission (UGC) to National Council of Education Research and Training (NCERT), most bodies under the Ministry of Education have received an increased allocation.

-

- Top business schools -- Indian Institutes of Managements (IIMs), which witnessed consistent cut in their allocated budget in a push to make them self-reliant, have also received an increased allocation of Rs 251 crore as against a revised estimate of Rs 227 crore last year.

-

- However, the budget granted to Indian Institute of Science, Education and Research (IISERs) has seen a drop of Rs 137 crore. Similarly, the allocated amount for World Class Institutions, has been reduced by more than 50 per cent. Last year, the amount allocated was Rs 1000 crore which has now been reduced to Rs 475 crore.

-

- Budget 2025-26: Govt earmarks Rs 300 cr for modernisation of prisons

-

- The Centre on Saturday proposed a budgetary allocation of Rs 300 crore for the modernisation of prisons during the next financial year, the same as the current fiscal but which was later revised to Rs 75 crore.

-

- According to the Budget presented by Finance Minister Nirmala Sitharaman, the provision is for the "expenditure on modernisation of prisons".

-

- In the 2024-25 fiscal, the government had initially made a provision of Rs 300 crore for prison modernisation, but it was later revised to Rs 75 crore.

-

- A sum of Rs 86.95 crore was given for the modernisation of prisons during 2023-24.

-

- According to the Union Home Ministry, it attaches high importance to efficient prison management and correctional administration due to the significance of prisons in the criminal justice system.

-

- In May 2023, the Home Ministry had finalised a comprehensive 'Model Prisons Act' with provisions regarding establishment and management of high security jail, open jail and "protecting the society from the criminal activities of hardened criminals and habitual offenders" among others.

-

- Its features include legal aid to prisoners, provision of parole, furlough and premature release etc. to incentivise good conduct. It also focuses on vocational training and skill development of prisoners and their reintegration into society.

-

- The Model Act is a comprehensive document which covers all relevant aspects of prison management including provisions for reformation, rehabilitation and integration of prisoners in the society.

-

- It also has provision for 'Welfare Programs for Prisoners' and 'After-Care and Rehabilitation Services', as an integral part of institutional care.

-

- Union Home Minister Amit Shah had said in 2023 that efficient prison management plays a critical role in the criminal justice system and the Government of India attaches high degree of importance to supporting states and union territories in this regard.