Nagaland

Chief minister presents deficit budget of Rs 1,437.84 crore for 2017-18

Kohima, March 28 (EMN): Chief minister, Dr Shurhozelie Liezietsu on Tuesday presented a Rs 1,437.84 crore deficit budget for the 2017-18 fiscal in the ongoing state assembly session.

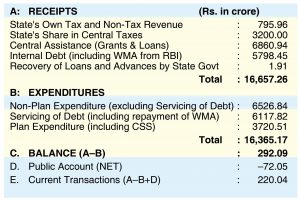

The chief minister, in his budget proposal, estimated the gross receipt for the fiscal at Rs 16,657.26 crore and expenditure at Rs 16,365.17 crore.

“The current year’s transaction is estimated to result in a positive balance of Rs 220.04 crore. However, because of the negative opening balance of Rs 1657.87 crore, the year 2017-18 is estimated to close with a negative balance of Rs 1437.84 crore,” Liezietsu told the assembly. (See box)

He pointed out that despite the 10% increase in the state’s share of central taxes – as required under the recommendations of the 14th Finance Commission – Nagaland was still ‘hugely in revenue deficit’. “That is why the 14th Finance Commission gave us substantial amounts in revenue deficit grants. But this deficit grant is just to cover the current revenue deficits; and there is no component for development works in it”.

Even for the coming fiscal, the chief minister said, the state government has to earmark not less than 50% of the state’s flexible fund “towards meeting the state’s share of central sector schemes” in order to avail the schemes from Delhi.

“Hence there is very little fund for undertaking new works under the state sector. A clear message that emerges out of this changed scenario is this: firstly, we have to economise our non-plan revenue expenditures, while improving our own revenue mobilisation, so as to make more funds available for developmental works. We have to be particularly careful not to engage any person in excess of the sanctioned posts.

“Secondly, the government departments should now focus more on effective implementation of centrally funded schemes, and compete with each other in availing such funds, instead of squabbling over the allocation of the rather small state flexible fund. This will be the best way we can take forward the developmental process in the state on a faster track.”

Out of the approximate Rs 3344 crore “indicated to the state” by the central government, he informed, the Nagaland government has managed to access “barely 50%” of the total amount till date. The assembly will discuss the budget on March 30 next.

GST will boost state revenue

The chief minister was confident the Goods and Services Tax (GST) regime, once implemented as expected from July 1 next, would bolster revenue generation in Nagaland.

“The key benefits of this new tax regime will be reduction in the cost of movement of goods across the country, and reduction of the incidence of multiple taxation on the same commodity, which results in high prices and inflation.

“Under the GST regime, the states will also be able to levy tax on certain services, which will help boost revenue of the states,” he said.

Later addressing a press conference, he said that the proposed budget envisages a total expenditure of Rs 16,375 crore from the state’s consolidated fund for the fiscal, out of which, Rs 12,655 crore is for non-developmental expenditure, hitherto known as Non-Plan fund, and the remaining Rs 3720 crore for plan expenditure.

“My budget lays emphasis on the upliftment of the poor and rural population as well as on education and health,” he said. The chief minister said the thrust of development expenditure is under social sector with 39% of the total development outlay meant for education, health, water supply etc., 19% on rural development, and 13% on agri and allied sector.

On the increase in deficit compared to the 2016-17 fiscal which stood at Rs 1194.35 crore, finance commissioner Temjen Toy replied that the government faced a number of difficulties during the course of the year.

He said revenue receipts had gone down and there was a reduction in the borrowing ceiling by as much as Rs 141 crore due to the revision of the GDSP by the government of India. Also, besides some other “unavoidable expenditures which had to be made”, the state government had to provide an additional Rs 65 crore as state share to avail more central funds.

Excess appointments in govt sector

When asked why the state government continues to make fresh appointments despite claims of increase in government employees every year to the extent that there is excess employees in various departments, the chief minister said there may have been excess appointments in the past but the government has decided to be “more careful now”.

At the same time, maintaining that appointments in some sectors were unavoidable, he cited the example of School Education department where the number of students keeps increasing and to commensurate with that increase, more teachers are appointed. He assured that if there were appointments made where not required, the government would check such irregularities in due course of time.

The chief minister also stated that before 6 June 2016, there was a clear government order that those who were appointed on contract will have to undergo suitability test after completion of 3 years of appointment for their services to be regularised. Due to this standing order, he said, appointments done on contract or ad-hoc basis and regularising their services is not ‘backdoor appointment’.

He further pointed out that the state cabinet had on 6 June 2016 decided to do away with this order and those appointed on contingency and emergency basis will have no right to claim that their services should be regularised after completion of 3 years.

On whether the state government would be taking any action in regard to its 2010 P&AR memorandum which exempts the home department to seek government clearance on appointment of lower grade staff, Liezietsu said the matter will be looked into. However, he refused elaborate further on it, saying, it was too early to comment on the issue.